The same principle is applied to investing in stocks as in currency pairs of the foreign exchange market. It’s necessary to monitor and carefully analyze financial and political news. When making a decision to open/close a deal, one should rely only on solid information from official sources.

Stocks include three different categories and each of them is marked by some particular set of properties: spreads, liquidity, volatility, and average invested volume.

The most liquid and reliable stocks are called "blue chips". Other categories are mid-caps (marked by average liquidity) and small-caps stocks (the riskiest – low liquidity, high volatility, small invested volumes).

Investors that prefer stocks can be also divided into several different categories:

- Passive. As a rule, they invest in "blue chips", but sometimes mid-caps and small-caps stocks as well. These investors pursue investment reliability and stable income.

- Active. They also prefer "blue chips", but quite often invest in mid-caps and sometimes even small-caps stocks. These investors strive to get the highest possible profit, but don’t like to risk too much.

- Speculators are in search of quick profits as soon as possible, that’s why they invest in the most liquid stocks, "blue chips".

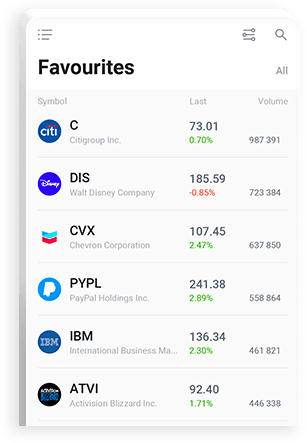

An investor’s choice of stocks is influenced by their investment strategy and attitude towards risks. Of course, stocks of such well-known companies as Apple, Google, Coca-Cola, IBM, Microsoft, General Motors do not always yield the highest possible profit, but they are surely not very risky. On the other hand, stocks of smaller companies may surprise you. It’s quite logical, because it takes a miracle to make Apple stocks skyrocket by 2-3 times, but a small retailing chain may quickly rise after opening several new shops and successfully providing promotional support.

As a result, “blue chips” are suitable for almost all categories of investors, but be careful when you invest in mid-caps and small-caps stocks.